就在美國的2025年5月27日,USDC的Circle Internet Group, Inc.又再次地向SEC申報了新一版的Form S-11,這次的內容增加了預計IPO的股數,以及預計的價格區間。

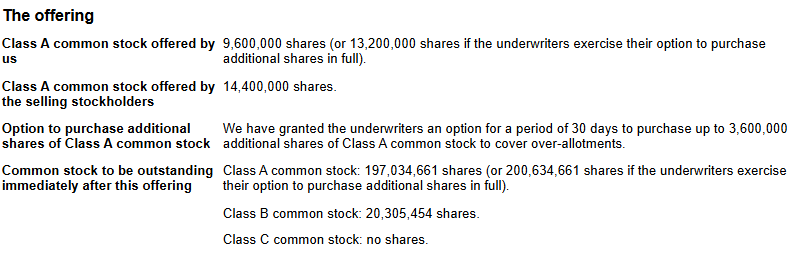

對於預計IPO的股數,以下是S-1的說明:

從文件中可以看到是9,600,000股的Class A普通股(由Circle發行的新股,並且可能最高到13,200,000股),以及14,400,000股的Class A普通股(由特定股東出售)。

但從上下兩張圖中可以看到,Circle在IPO之後預期的Class A普通股總股數是遠大於本次新發行以及特定出售股東所持有的股數。這到底是怎麼一回事?怎麼有一堆普通股不在IPO的範圍內?

這個差異源自於台美之間關於股票上市買賣制度的差異。

在台灣,一間公司進行IPO將會導致全部的普通股一次性的掛牌交易。所以,IPO之後,不論是新股東、舊股東,都可以透過集中交易市場交易普通股。

在美國,一間公司進行IPO只會針對IPO所指定範圍的股份進行掛牌交易,公開說明書也只會針適用到指定範圍的股份。所以,IPO之後,仍有部分的舊股東是無法直接透過公開交易市場交易持股的。

這也是之所以美國的募資文件通常利用相當大的篇幅處理Registration Right這件事。在Circle的情況,當Circle完成IPO以及閉鎖期間180天後,Circle將可能面臨部分原有股東提出針對老股申報的要求。

Registration rights

Pursuant to the Investors’ Rights Agreement, and from time to time, in connection with business arrangements with our partners, certain of our stockholders and their permitted transferees are entitled to the following rights with respect to the registration of such shares for public resale under the Securities Act. If exercised, these registration rights would enable holders to transfer these shares under the registration statement without restriction under the Securities Act.

Demand registration. Commencing 180 days following this offering, these holders may request in writing that we effect a resale registration under the Securities Act with respect to all or any portion of their shares subject to registration rights, subject to certain exceptions. If the holders requesting registration intend to distribute their shares by means of an underwriting, the managing underwriter of such offering will have the right to limit the numbers of shares to be underwritten for reasons related to the marketing of the shares. We are not obligated to effect more than two such demand registrations.

Piggyback registration. In the event that we propose to register any of our securities under the Securities Act, either for our account or for the account of our other security holders, holders will be entitled to certain piggyback registration rights allowing each to include its shares in the registration, subject to certain marketing and other limitations. As a result, whenever we propose to file a registration statement under the Securities Act, other than with respect to a demand registration or a registration statement on Form S-4, F-4, or S-8, these holders will be entitled to notice of the registration and will have the right to include their registrable securities in the registration, subject to certain limitations.

Shelf registration. These holders may request that we file and keep effective a shelf registration statement pursuant to Rule 415 under the Securities Act with respect to all or any portion of their shares subject to registration rights, subject to certain limitations. We are not obligated to effect more than one such shelf registration in any 12-month period.

Expenses; indemnification. We must pay all registration expenses (including certain expenses of counsel for selling holders) in connection with effecting any demand registration, piggyback registration, or shelf registration. The Investors’ Rights Agreement contains customary indemnification and contribution provisions.

Term. The registration rights will remain in effect until the earlier of (i) five years after this offering, (ii) with respect to a holder, during such time during which all registrable shares held by such holder may immediately be sold under Rule 144 during any three-month period and (iii) the closing of a liquidation event.

但如果你是持股極少的投資人,公司沒給予這樣的承諾,怎麼辦?

這時候你就只能回頭去看看SEC有沒有什麼safe harbor豁免規則(通常是Rule 144),可以讓你仍然可以公開交易你所持有的股票。以Rule 144為例,可能需要符合一定持有期間的條件。

最後,你還會需要找到公司的transfer agent(類似台灣的股務機構),完成一定的手續(當中可能還需要當地律師出具法律意見書)之後,才能公開交易。

https://www.sec.gov/Archives/edgar/data/1876042/000119312525126208/d737521ds1a.htm#rom737521_2